Once you have set your primary integration options on the Config GL Interface (Distribution) screen, you need to setup GL interface records (or "integration tables") corresponding to the options you have chosen. You do this using the GL Interface master file in MDS (refer to "File - GL Interface").

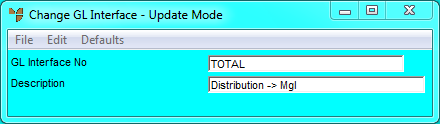

A simple General Ledger generally only has two GL interface records - TOTAL and DEBTBANK. The following screens show how these GL interface records should be setup.

An GL interface record called TOTAL is compulsory within MDS. It is the standard, multi-purpose GL interface record setup to accumulate financial transactions to the General Ledger.

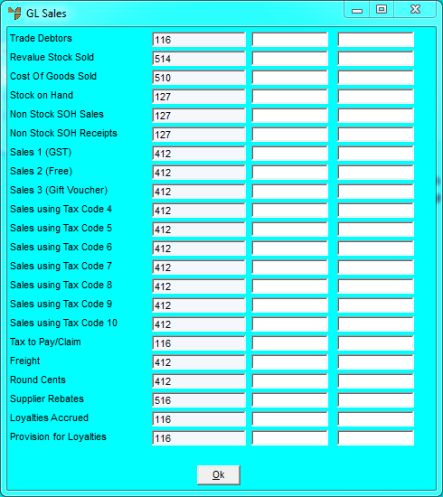

EDIT | SALES

In the example above, Tax to Pay/Claim has been set up to transfer transactions to the Journal Clearing Account. Where this option is not being used, the field can be left blank or Journal Clearing Account can be used to capture any entries posted in error. Where this feature is intended for use, you need to enter a GL account in the Current Liabilities section of the Chart of Accounts.

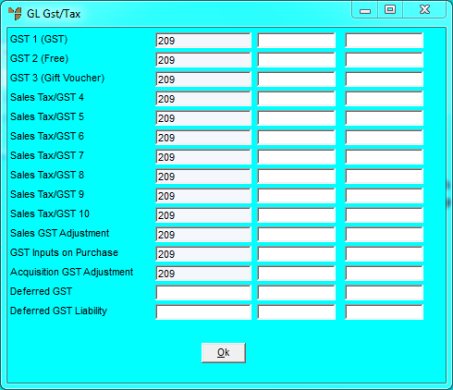

EDIT | TAX AND GST

In the example above, adjustment accounts are set to the main GL accounts for GST Collected and GST Paid. If you intend to report these separately from the major GST Liability Accounts, you need to setup these GL accounts in the Chart of Accounts and enter them here. A separate GL account for Sales GST Adjustments and another for Acquisition GST Adjustments should be created in the Current Liabilities section of the Balance Sheet if you are intending to report these adjustments separately.

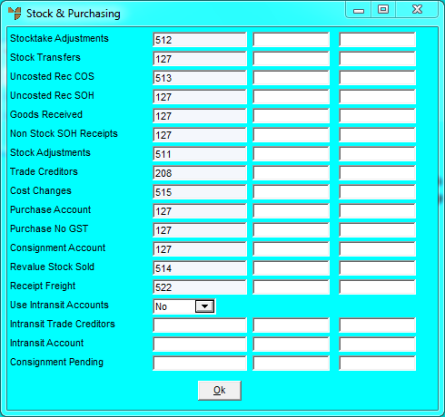

EDIT | PURCHASING AND STOCK

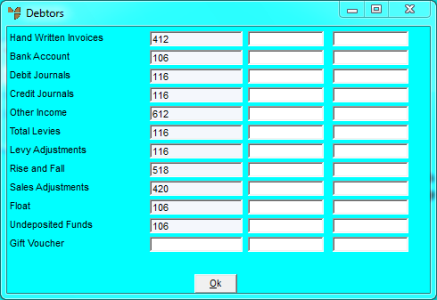

EDIT | DEBTORS

In the example above, Debit Journals and Credit Journals are set to transfer transactions generated from the Debtor Journals program to Journal Clearing account. Where GL Dissect is set on the Config GL Interface (Distribution) screen, the GL account chosen by the user during data entry overrides these settings.

In the case of Total Levies and Levy Adjustments, these fields are set to Journal Clearing Account even where Levies have been disabled. If the Levy program is enabled, you need to setup GL accounts under Revenue in the Chart of Accounts and enter these accounts here to ensure that transactions transfer to the correct area of the Profit & Loss statement.

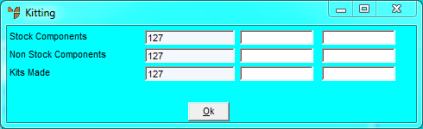

EDIT | KIT

In the example above, all kit components and kitted items are transferred in and out of the same Stock account. However, where a business chooses to report raw materials (Stock Components and Non Stock Components) transferring to Finished Goods (Kits Made) separately, you need to setup Stock GL accounts in the Inventory section of the Chart of Accounts and enter those accounts here.